It also accounts for non-cash expense items and cash requirements alerts for maintaining the minimum required balance. Efficiently manage your business’s cash flows with the Cash Flow Analysis Template. This financial spreadsheet solution enables you to predict cash shortfalls and excesses in advance, optimizing your financial plans. By calculating your net cash flow and showing your opening and closing balance, this template provides you with a clear view of your financial health and aids in better financial planning. Free cash flow takes into account cash flow from operations, and the cash required to pay for capital expenditures (CAPEX).

Functions Used in the Excel Cash Flow Statement Template

It should be customized to include the specific types of cash flow activities that apply to your company. To fill out this spreadsheet, enter the applicable values in their respective cells. An example cash flow statement is also included to help guide you through the process. Alternatively, you can easily create a cash flow statement based on an accounting system such as QuickBooks.

Cash Flow Templates

Likewise, be cognizant of especially complicated or large transactions on the horizon and how they might impact your cash flows. Coefficient’s Simple Cash Flow Template empowers you with the tools needed for effective financial planning and risk management. It’s designed for businesses seeking to maintain a clear view of their financial status, fostering growth through informed decision-making. Don’t let the complexities of cash flow management hinder your business’s potential.

How to Use the Indirect Cash Flow Method

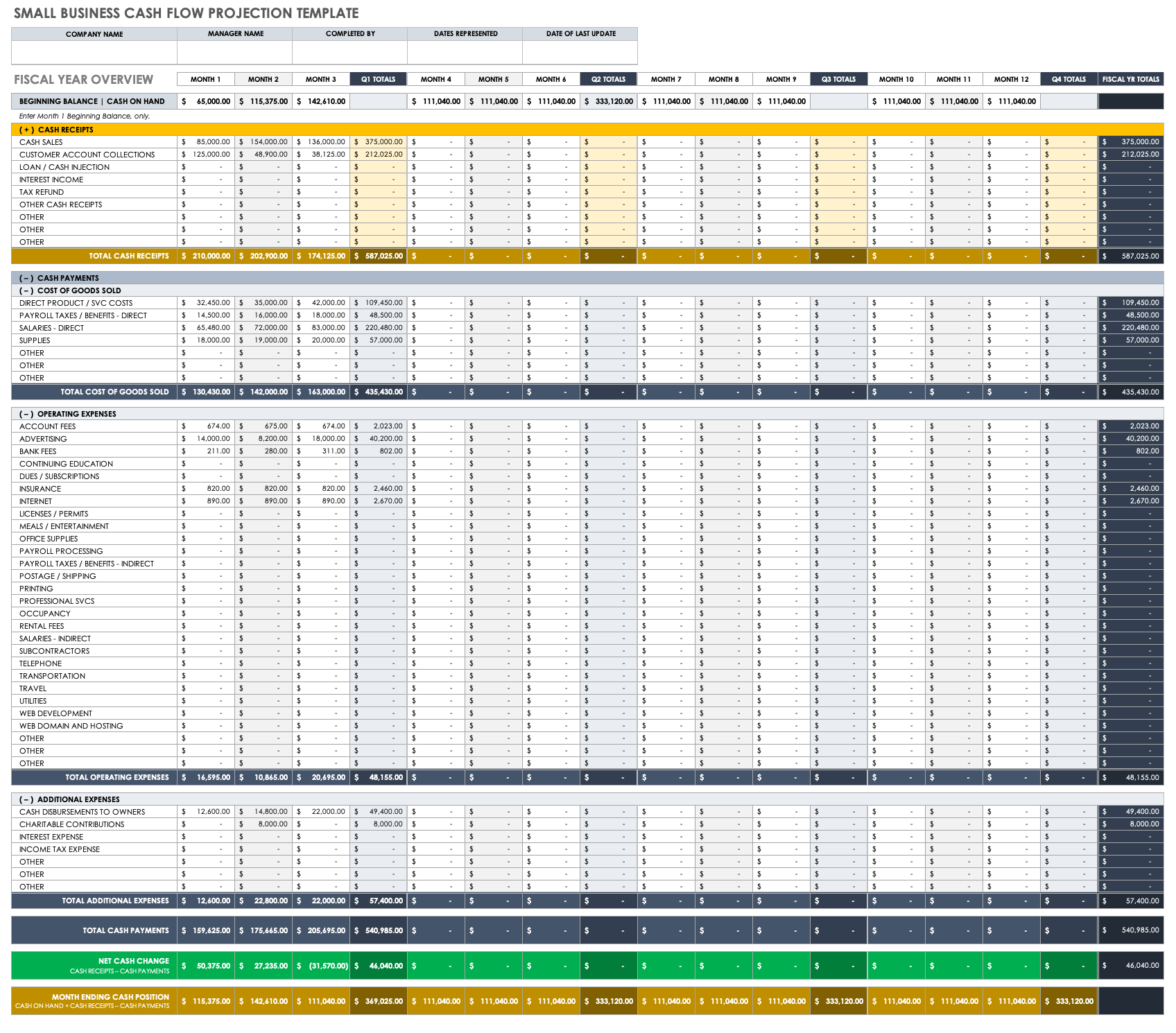

If you want to use a free spreadsheet with the ability to enter transactions in account registers like you do in Quicken, you can try the Money Management Template. This worksheet was created to be used as an educational resource for personal finance classes. It includes a fairly comprehensive set of expense categories and was designed to be easy to understand and simple to customize. It’s mainly for people who don’t already use Quicken (you can generate a report like this from Quicken very easily via the Reports menu). It covers a wide variety of financial components such as cash on hand, sales, collections, loans, expenses, purchases, wages, and much more, allowing you to keep track of your income and expenses in one place. More importantly, it encapsulates outflows in detail, including the cost of goods, delivery fees, marketing, subscriptions, travel expenses, payroll, and more.

- For instance, embedding links to trial balance and financial statement reports rather than manually entering the data saves time, resources, and significantly reduces the chances of error.

- It starts with the opening balance and then provides space to record monthly cash inflow from various sources, such as contract payment claims, other receipts, and cash sales.

- Such as license income, the share of profits from joint ventures or grant monies received.

- In order to fill out a cash flow statement, you will need your most recent income statement and balance sheet.

steps to prepare a bank reconciliation statement

“Expenses“ is an extensive category that captures not just your restaurant’s operational expenses but also marketing, subscriptions, travel, equipment, payroll, general, and research & development expenses. The template allows you to examine your finances in detail, with fields for specific items such as auto maintenance, child care, eating out, groceries, and more. Bank reconciliation is a crucial financial process for businesses to ensure that records match… However, these templates offer relatively basic functions and require a lot of back-end work in order to organize your financial information.

A Guide to Cash Flow Statements with Template

A cash flow statement, along with the balance sheet and income statement, is one of the primary financial statements used to measure your company’s financial position. It tracks the inflow and outflow of cash from operating, investing, and financing activities during a given time period. The term “cash” refers to both cash and cash equivalents, which are assets readily convertible to cash. This financial statement provides relevant information to assess a business’ liquidity, quality of earnings, and solvency. A cash flow statement, along with the balance sheet and income statement, is one of the primary financial statements used to measure your company’s financial position. It tracks the cash inflow and cash outflow of cash from operating, investing, and financing activities during a given time period.

Subtract any cash payments to suppliers for goods and services related to the company’s core business activities. Begin by listing the opening balance of cash and cash equivalents for the reporting period. For more information, you can also read cash flow statements explained here. Procrastination is the mortal enemy of nearly every financial function, from audit preparation to, you guessed it, your cash flow worksheet. Just as you’ve always heard, don’t leave for tomorrow what you can do today. Stay on the ball throughout the year to avoid rushed work and entries that don’t lend themselves to accuracy and reliability.

Coefficient’s Simple Cash Flow Template brings you the simplicity and precision you need to handle your finances more effectively. Empower invoice template for google docs your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

It also includes a terminal value model, allowing for the estimation of a business’s value into perpetuity. The Discounted Cash Flow Template from Smartsheet is an all-in-one solution for detailed financial analysis and business valuation. Designed for those with a detailed understanding of finance concepts, this comprehensive Google Sheets template allows you to capture all aspects of a company’s financial position in one place. Having cash and cash equivalents on your balance sheet shows investors or lenders that your business is healthy. In order to complete the cash flow statement template, here are the most essential details to know. A cash flow statement is a critical tool for analyzing the current liquidity of any business venture.

Automate your cash flow statements with QuickBooks cash flow planner and take control of your cash flow. The extra cash might be used to pay a dividend to investors, or it can be retained in the business to expand operations. Well-managed companies plan for capital expenditures, which may include investments in machinery, equipment, and other long-term assets. A chain of restaurants, for example, must eventually replace ovens, refrigerators, and furniture.

Use this template to determine whether your nonprofit will have enough cash to meet its financial obligations. There are sections for cash receipts, contributions and support, government contracts, other revenue sources, and receivables from previous years. This template is completely customizable, and provides insight into monthly and yearly carryover, so you can keep tabs on your rolling cash balance. Use QuickBooks free cash flow statement template to clarify your company’s position on cash.